.png)

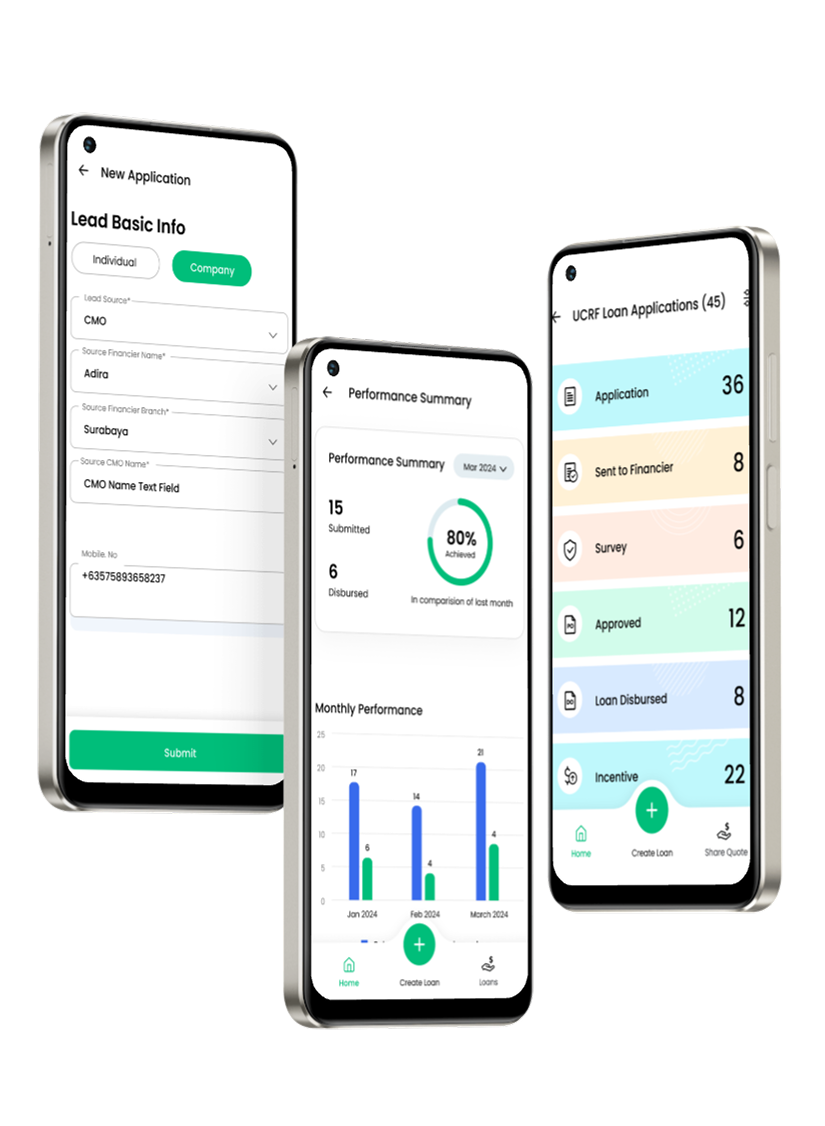

During my summer internship at CarDekho, I worked on a mobile app for agents assisting individuals and car companies with loan applications. The goal was to streamline the process so agents could efficiently manage client data, track performance, and support loan approvals. I was brought in at the early stages of the project and led the end-to-end design from scratch. This included understanding user needs, defining the core workflows, and building the initial prototypes and visual system.

CarDekho, one of India’s leading automotive marketplaces, wanted to equip its agent network with a mobile loan application system that could help individuals and car dealers secure financing quickly. Loan officers often worked in fast-paced environments, juggling multiple clients and paperwork-heavy processes.

The existing loan application process was time-consuming, error-prone, and fragmented — requiring agents to switch between multiple platforms, manually collect documents, and track loan status through informal channels. This inefficiency delayed approvals, frustrated both agents and customers, and limited CarDekho’s ability to deliver a seamless financing experience.

A centralized app that enables efficient client data management, loan tracking, and performance evaluation, while minimizing manual processes.

How might we create a centralized app that simplifies loan management, provides real-time updates, and improves communication to help agents work efficiently and serve clients better?

To gather valuable insights, I conducted 10 in-depth interviews with agents who regularly manage loan applications. These interviews were conducted via Zoom and lasted between 30-45 minutes each. The goal was to explore their day-to-day experiences, challenges, and preferences when handling loan applications. I structured the interviews to uncover both qualitative and quantitative data, focusing on key aspects of their workflow.

Workflow Challenges:

Can you walk me through your typical day managing loan applications?

What are the most time-consuming or frustrating parts of your current process?

Access and Efficiency:

Do you face any difficulties accessing client information or tracking loan statuses quickly?

How do you currently track your performance (loan approvals, pending applications)?

App Expectations:

What features would you find most useful in a loan management app?

How do you envision an app improving your workflow and productivity?

After conducting these interviews, I analyzed the responses to identify common pain points and needs across different agents. This helped prioritize the core features and functionalities for the app, ensuring it directly addressed the challenges they faced in managing loan applications.

The user flow for this loan management app is designed to guide agents seamlessly through essential tasks, ensuring efficiency and clarity. Starting with a straightforward login process, users proceed to a detailed onboarding flow to input personal and professional information. The dashboard serves as the central hub, offering quick access to features like performance tracking, loan management, and client interactions. Users can create new loans, view applications, and use filters to streamline their workflows. This intuitive flow reduces complexity, saving time and improving the overall user experience

.png)

.png)

.png)

.png)

My internship at CarDekho was an incredible experience and a significant milestone in my journey as a UX Design Intern. It was my first professional opportunity, and I learned so much during my time there. I had the privilege of working under an amazing manager, Ravinder Singh, who provided invaluable guidance. Being part of meetings with the development team and witnessing my designs come to life was both humbling and fulfilling. It validated my abilities as a designer and boosted my confidence in my skills. This was also my first experience handling a design project independently, which made it even more rewarding. My time at CarDekho not only enhanced my skills as a designer but also contributed to my personal growth, leaving me deeply grateful for the experience.